Home Health Care Gained a Greater Share of Post-Acute Admissions Post-COVID

The home health industry gained a more significant share of post-acute care admissions after the onset of the COVID-19 pandemic, new data shows.

There was certainly a feeling at the time that home health agencies were gaining more patient admissions that may have previously gone to skilled nursing facilities (SNFs). And while some data has reflected that already, if there was any remaining doubt, the Medicare Payment Advisory Commission’s (MedPAC) July 2022 data book should cast that aside.

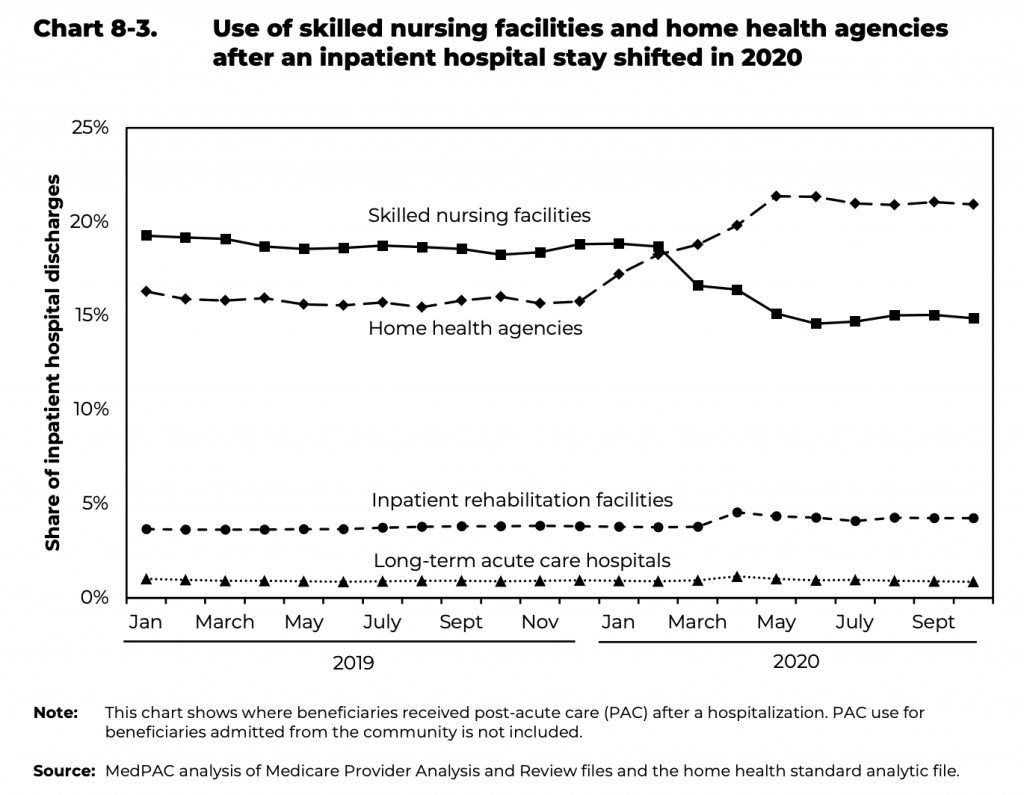

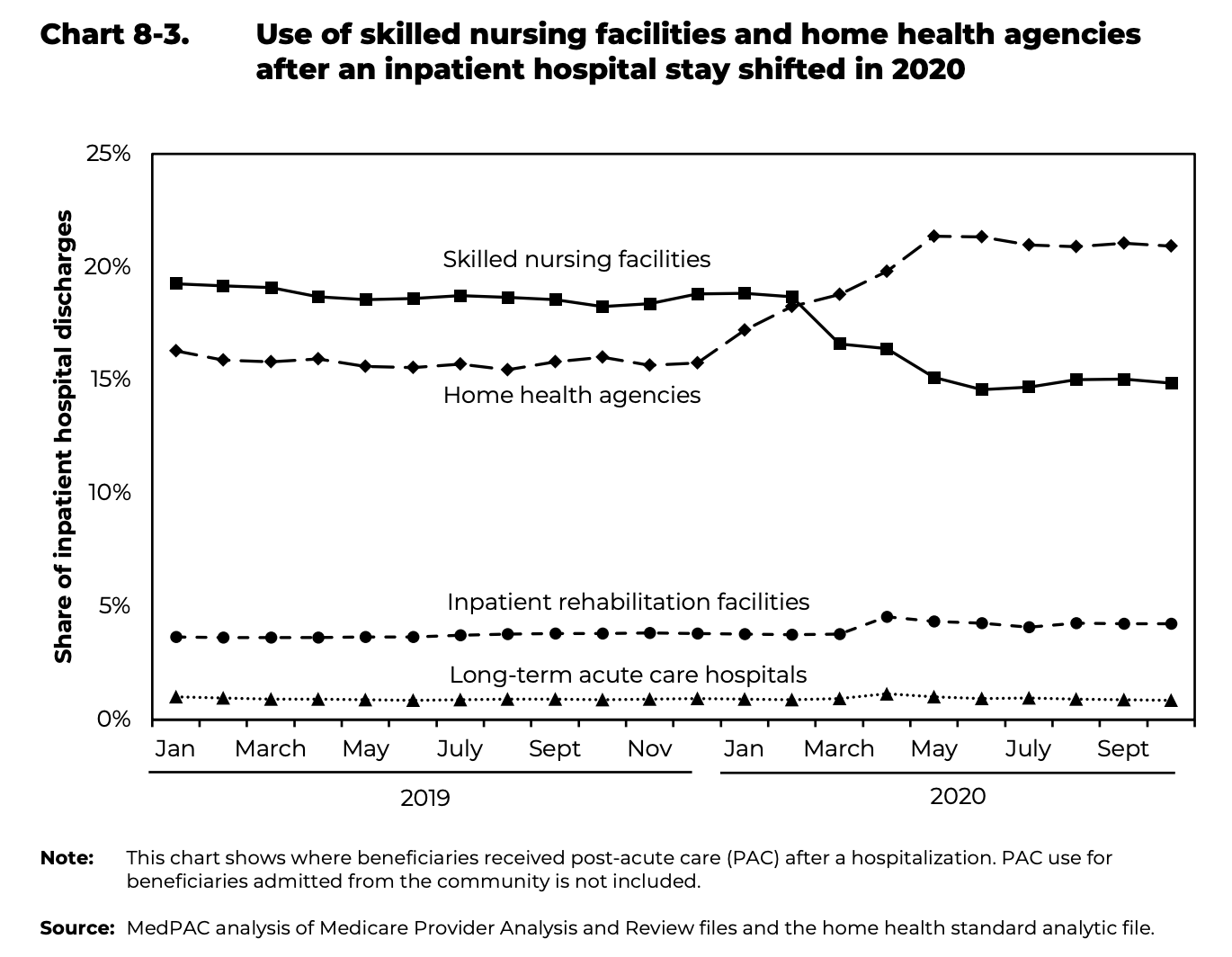

“In March 2020, at the onset of the COVID-19 public health emergency, the share of inpatient hospital discharges referred to SNFs declined to 16.6% and by October 2020 had reached 14.9%,” the data book highlighted. “By contrast, the share receiving home health care services increased to 20.9%.”

That change was due to the pandemic-related struggles that SNFs faced, both at the onset of the pandemic and throughout its first year. As of March 2021, nearly 1 in 10 nursing home residents had died of COVID-19, according to The COVID Tracking Project.

“The shift to home health care reflected the pandemic-related effects experienced by nursing homes and the reluctance of beneficiaries to use them,” MedPAC said in its report.

At the time, while SNF operators acknowledged the trend highlighted above to some extent, many of them were ardent believers in the idea that the trends would recalibrate once the COVID-19 situation normalized.

Home health providers, however, had other ideas. The Choose Home Care Act of 2021 – which would create an add-on to the home health benefit, giving nursing home-eligible Medicare beneficiaries more options – is evidence of that.

“I’ve been working in the home health space for a long time,” Joanne Cunningham, the executive director of the Partnership for Quality Home Healthcare (PQHH), told Home Health Care News last November. “And there’s always been this question of, ‘OK. What percentage of SNF patients could be appropriately and safely cared for in the home?’’’

However, despite strong bipartisan support, the Choose Home legislation has hit roadblocks that have kept it from being enacted.

Fewer home health agencies

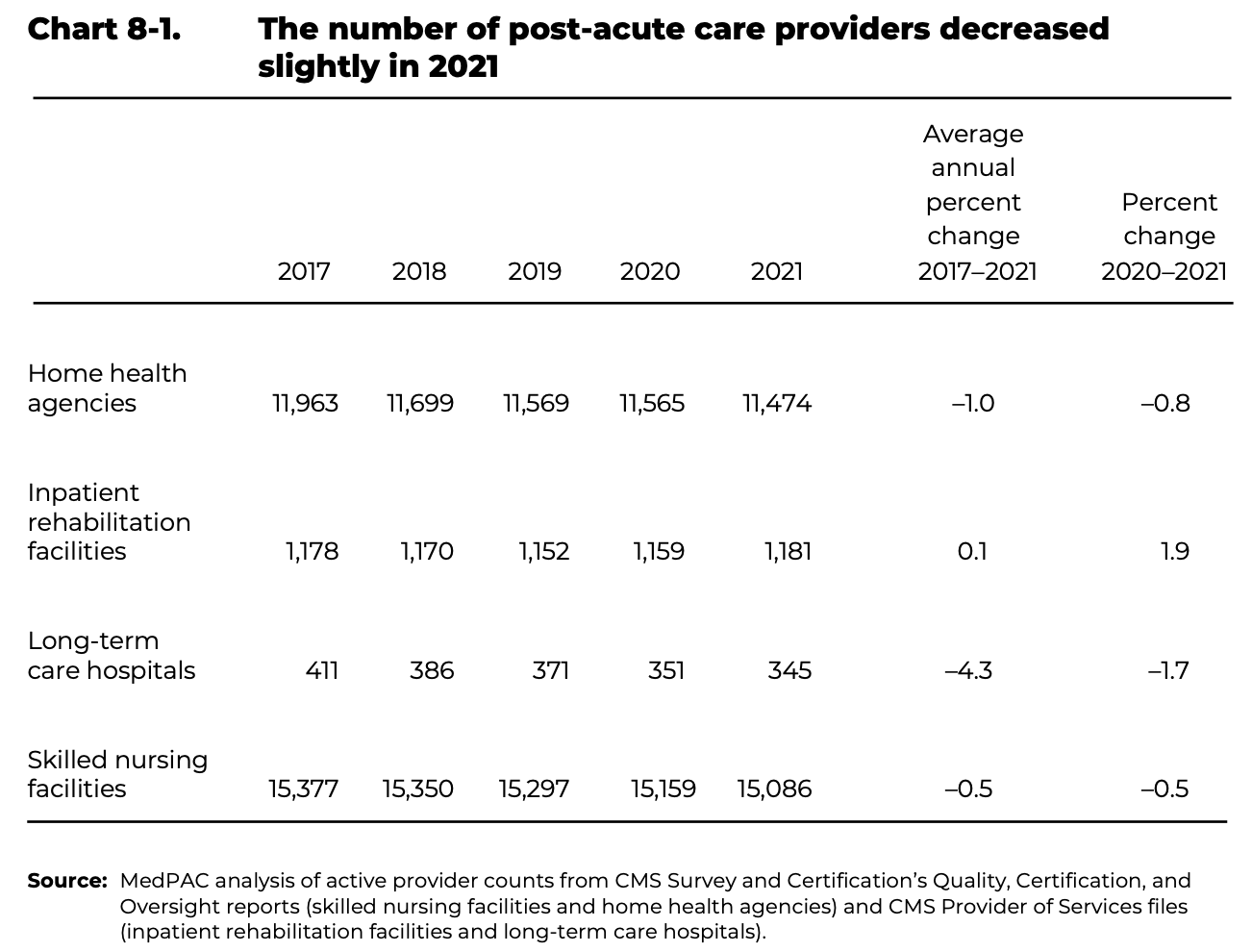

The number of home health agencies in the U.S. yet again declined, according to MedPAC data, despite the growing support and demand for their services.

That decline has been ongoing since 2013 after several years of “substantial growth.” From 2020 to 2021, the decline was mostly visible in Texas and Florida, which were two of the states that showed considerable growth at the beginning of the century.

Specially, there were 91 less agencies in 2021 than there were in 2020, a 0.8% decline. That’s a slightly smaller decline compared to other years from 2017 to 2021, where the average decline has been about 1%.

Despite the share of post-acute admissions favoring home health providers more during the early stages of the pandemic, care was still disrupted.

“Total spending declined by 4.7% and the number of beneficiaries using home health care decreased 7.3%,” MedPAC wrote. “However, the decline in volume in 2020 was concentrated in March and April of that year.”

At the same time, the number of beneficiaries declined by more than the drop in total spending, meaning the average payment per home health user increased by 2.8% in 2020.