Health Care Costs Are a Driver of Health Across All of America – Especially for Women – HealthPopuli.com

Three in four people in America grade health care costs a #fail, at grade “D” or lower.

This is true across all income categories, from those earning under $24,000 a year to the well-off raking in $180K or more, we learn in Gallup’s poll conducted with West Health, finding that Majorities of people rank cost and equity of U.S. healthcare negatively.

Entering the fourth quarter of 2022, several studies were published in the past week which reinforce the reality that Americans are facing high health care costs, preventing many from seeking necessary medical services, and hitting under-served health citizens even harder in the economic downturn that so many U.S. families are facing vis-à-vis inflation for food, energy, and housing prices — three basic needs in the Maslow Hierarchy of Needs that drive well-being.

I’ll weave in several of these reports’ findings in the Hot Points below with links to this important research.

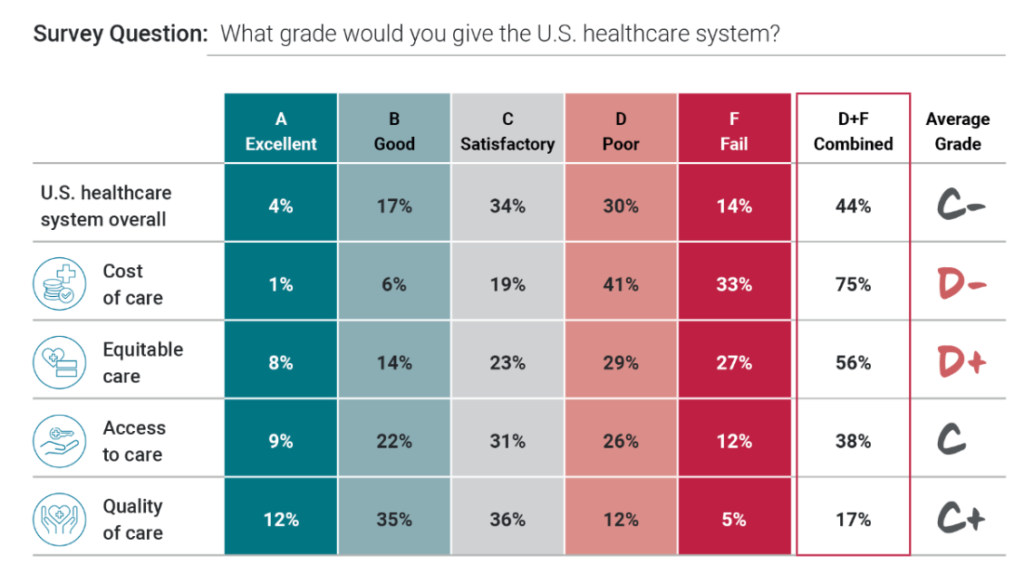

First, to the Gallup/West Health findings: here’s the top-line report card in the first chart from the study, which was conducted among over 5,500 U.S. adults in late June 2022.

Across four categories or ratings, only quality of care garners a majority of good-or-excellent grade, but still manages only an overall C+.

Cost of care ranks at bottom with a D-, followed by equitable care receiving an overall D+ mark.

Health care costs continue to prevent millions of patients from seeking care in the current inflationary economic environment which has exacerbated Americans’ medical self-rationing behavior.

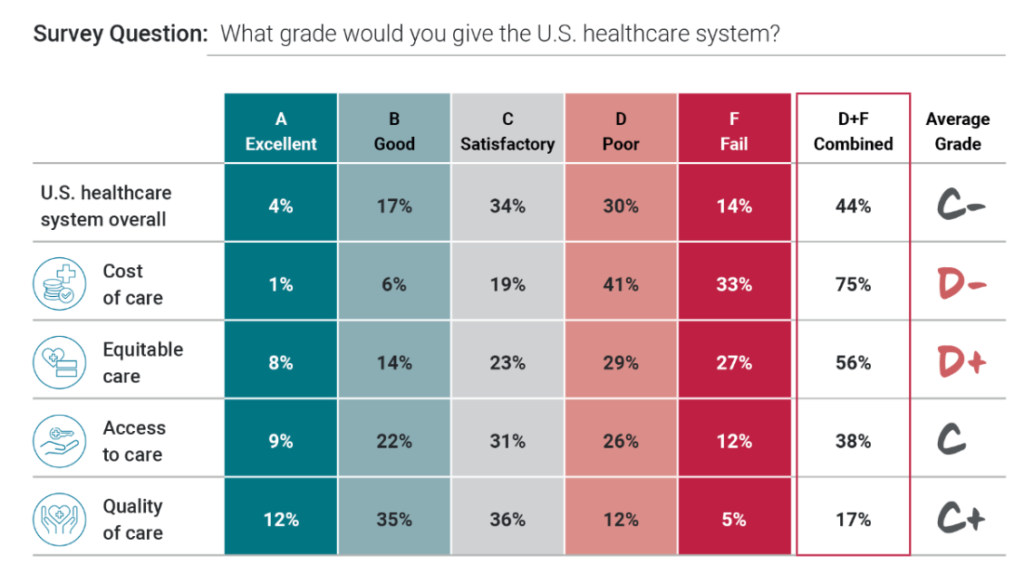

The second bar chart illustrates that women as well as Black and Hispanic Americans are more like to cut back on health care to pay for household expenses.

It should be no surprise to you, then, that Black and Hispanic Americans were more likely to grade quality as a “D” or “F” in this poll.

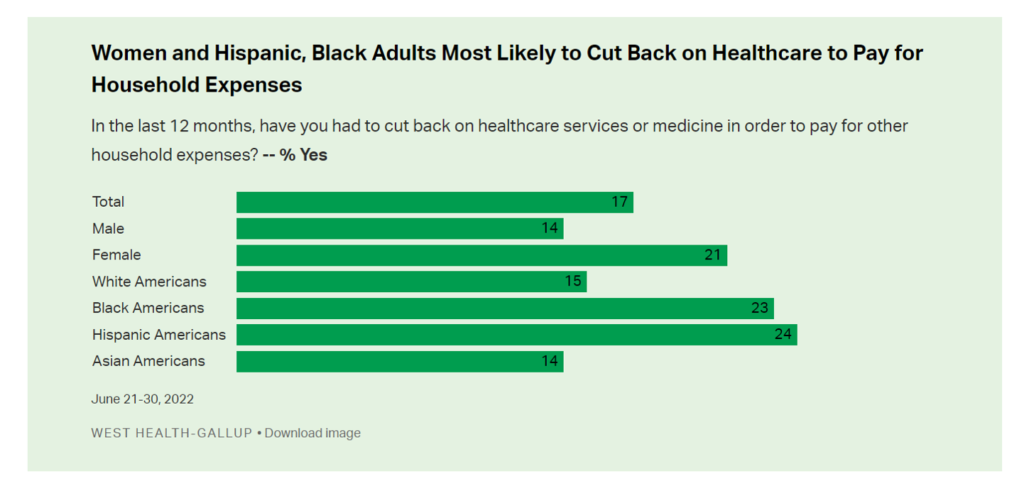

Health Populi’s Hot Points: Even those people who have health insurance in the U.S. avoid care due to cost. The latest Robert Wood Johnson biennial survey on the state of health insurance shows that over two in five working-age people in the U.S. are under-insured even as members in a health insurance plan through work or self-paid through an insurance marketplace.

The pie chart details the picture that 23% with insurance all year were underinsured (that is, could not afford care), and 11% insured now had a coverage gap.

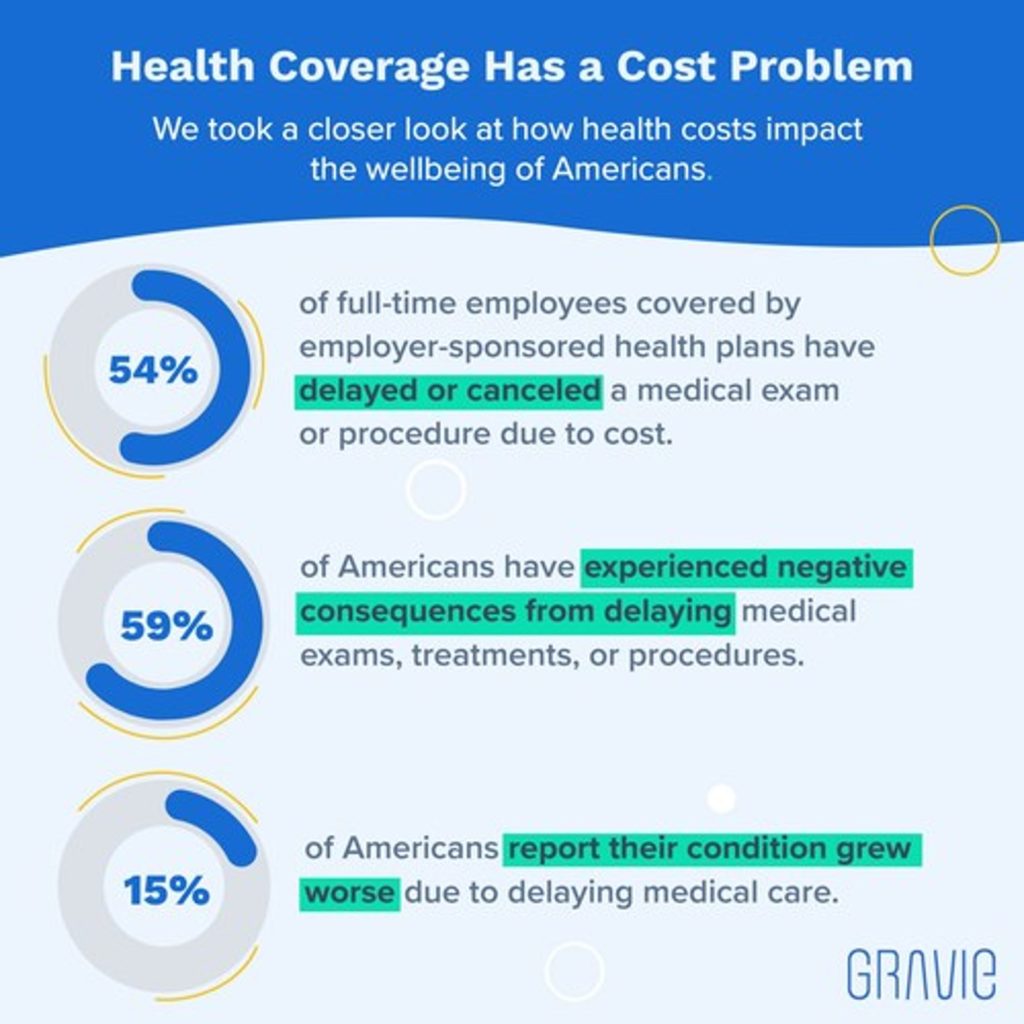

Thus, “health coverage has a cost problem,” another study from Gravie concluded.

Over one-half of working-age health-insured people with employer-sponsored plans delayed or canceled a medical exam or procedure due to cost. Furthermore, most of those who delayed care had negative health consequences from doing so, with 15% of folks reporting their condition worsened due to postponing needed care.

Gravie polled 1,000 U.S. consumers in August 2022, further learning that 80% of covered people were concerned that their health benefit would not pay for/cover their exams, treatments or procedures under their insurance plan.

In addition, 7 in 10 of these covered working consumers said their insurance did not cover mental health, and those with mental health coverage worried that the benefit would not meet their or their families’ mental health needs.

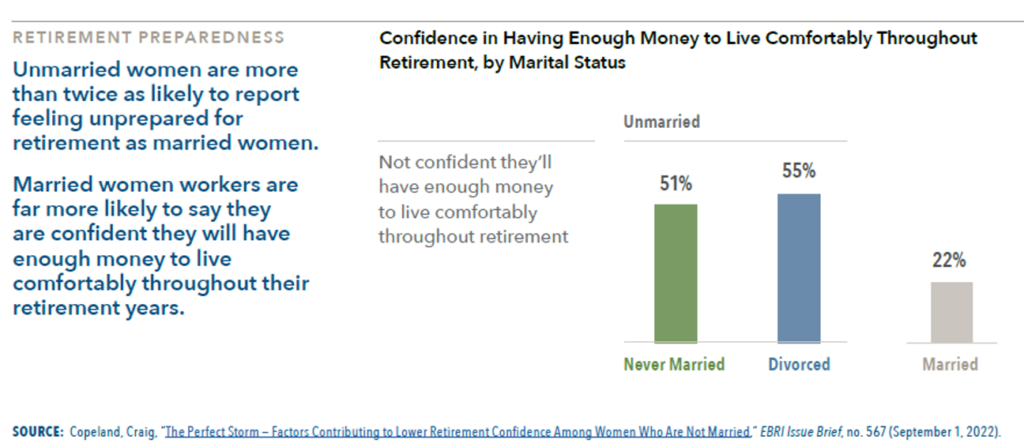

EBRI, the Employee Benefit Research Institute, also published a report which focused on the retirement confidence of women in the U.S.

Bolstering Gallup/West Health’s finding that women in the U.S. feel more health-financially vulnerable than men, EBRI discovered that women who were either never married or divorced are more at-risk of lacking confidence in having sufficient money to live comfortably through retirement.

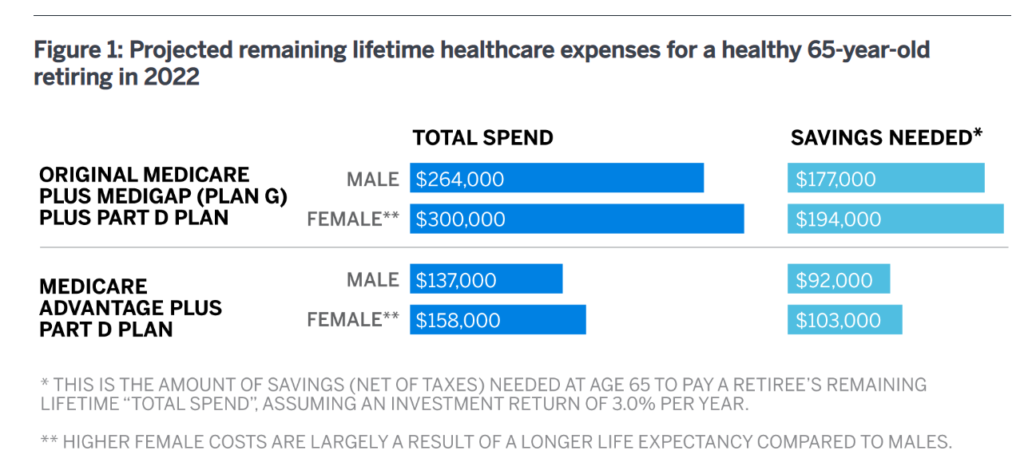

There’s a rational, if fiscally-frightening, reason why: this bar chart from Milliman’s latest look into health care costs in retirement calculates that a healthy 65-year-old woman retiring in America in 2022 would need $194,000 saved to cover an Original Medicare plan plus Medigap and Part D for prescription drugs.

A healthy 65-year-old man would need $17K less than his female counterpart, a tidy sum of $177,000 for the Original Medicare + Medigap + Part D plans.

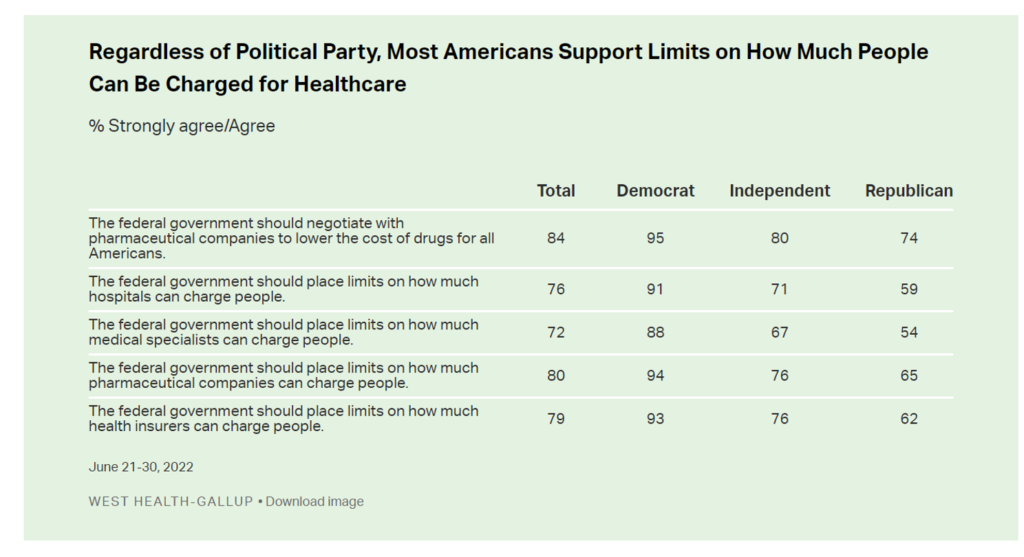

Health care costs are one issue that bonds right, left, and center Americans across the political spectrum.

From Gallup/West Health’s study, in this last table we see that politics doesn’t make a difference when it comes to American health citizens’ views on health care costs in the U.S. Across party affiliation, people-as-health-consumers and health citizens support limits on how much they can be charged for health care.

As we approach the 2022 election mid-terms in just a month’s time, remember that voters — and especially women who vote in the U.S. — will vote on health care issues beyond Dobbs/Roe v. Wade. Health care access also means being able to afford medical care, and these studies woven in today’s Health Populi blog tell that very current story.