Gilead pays $60M to strike up another cancer drug alliance with MacroGenics – MedCity News

Gilead Sciences has expanded its cancer therapies portfolio and pipeline by striking deals and its latest one has the pharmaceutical company partnering with MacroGenics on the development of bispecific antibody drugs for cancer.

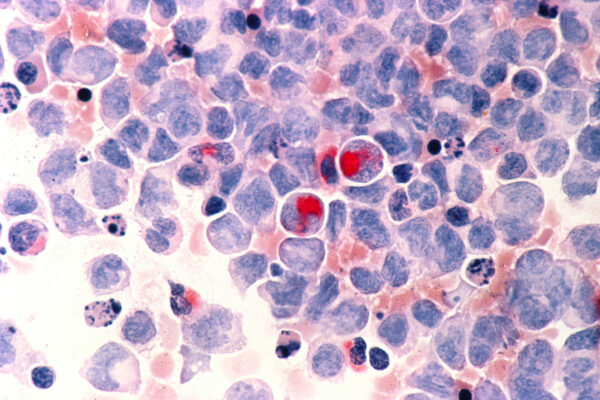

Gilead is paying $60 million up front to kick off the alliance, which gives the Foster City, California-based drugmaker an option to license MGD024, a drug in development for treating two blood cancers: acute myeloid leukemia (AML) and myelodysplastic syndrome (MDS). The deal terms announced Monday also includes the opportunity for the partners to collaborate on two additional bispecific research programs.

Bispecific antibodies bind to two targets simultaneously. MGD024 is designed with one arm that binds to CD123, a protein overexpressed by blood cancer cells, and another arm that binds to CD3 on the surface of T cells. There are no FDA-approved drugs that target CD123, but several companies are pursuing that target.

CD3 is already targeted by antibody drugs but Rockville, Maryland-based MacroGenics is aiming for a safety edge. Drugs that hit this immune cell target can also activate inflammatory signaling proteins called cytokines. The resulting excessive immune response, called cytokine release syndrome (CRS), is a dose-limiting complication of such therapies.

MacroGenics designed MGD024 to engage CD3 in a way that minimizes cytokine release. In preclinical research presented last year during the annual meeting of the American Society of Hematology, MacroGenics reported that MGD024 showed activity against leukemia as well as reduced release of pro-inflammatory cytokines. A Phase 1 study began over the summer enrolling patients with CD123-positive blood cancers.

According to the terms of the deal with Gilead, MacroGenics will continue the Phase 1 study. This study includes a dose-escalation portion and an expansion part that will evaluate the MacroGenics drug as a monotherapy and in combination with other therapies across multiple indications. Gilead may exercise its option to license the program at predefined decision points that were not disclosed. MacroGenics could receive up to $1.7 billion in target nomination and option fees, plus development, regulatory, and commercial milestones. If Gilead is able to bring the drug to market, it would owe MacroGenics royalties from sales.

Another MacroGenics bispecific antibody, flotetuzumab, had previously reached Phase 1 testing in AML. While MacroGenics said the therapy’s activity looked promising and side effects were manageable, the company decided to stop development of that drug in favor of MGD024, which may offer dosing advantages and the ability to be combined with other therapies. MacroGenics has described MGD024 as the next-generation version of flotetuzumab. In addition to the lower risk of CRS, MGD024 has a longer half-life that permits less frequent dosing.

“MacroGenics’ bispecific expertise naturally complements Gilead’s portfolio strengths in immuno-oncology and our growing hematology franchise,” Bill Grossman, Gilead’s senior vice president, oncology clinical development, said in a prepared statement. “We believe MGD024, with its potential to reduce CRS and permit intermittent dosing through a longer half-life, could translate to more patient-friendly dosing and enhanced clinical outcomes for people living with AML and MDS.”

Gilead’s new alliance is its second with MacroGenics. In 2013, the companies struck up a partnership on the development of up to four molecules developed from MacroGenics’s platform technology. The research and development period expired without Gilead licensing any MacroGenics molecules.

The Gilead pipeline already has drug candidates for AML and MDS. Magrolimab, an antibody drug that targets the cancer protein CD47, is in Phase 3 testing for both types of blood cancer. Gilead acquired that drug via its $4.9 billion buyout of Forty Seven in 2020.

Public domain image from the National Cancer Institute