FAQs on Medicare Financing and Trust Fund Solvency

Medicare, the federal health insurance program for 65 million people ages 65 and over and younger people with long-term disabilities, helps to pay for hospital and physician visits, prescription drugs, and other acute and post-acute care services. In 2021, Medicare benefit payments totaled $689 billion, net of premiums and other offsetting receipts. Accounting for 20% of national health care spending and 12% of the federal budget in 2020, Medicare spending often plays a major role in federal health policy and budget discussions.

In discussions of Medicare’s financial condition, attention frequently centers on one specific measure—the solvency of the Medicare Hospital Insurance (HI) trust fund, out of which Medicare Part A benefits are paid. Based on current projections from the Medicare Board of Trustees, the HI trust fund is projected to be depleted in 2028, six years from now. Although the HI trust fund depletion date is only one way of measuring Medicare’s financial status and doesn’t present a complete picture of total program spending and revenues, it does indicate whether there is an imbalance between spending and financing of inpatient hospital and other benefits covered under Medicare Part A. These FAQs answer key questions about Medicare financing and trust fund solvency.

How is Medicare financed?

Funding for Medicare, which totaled $888 billion in 2021, comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1). Other sources include taxes on Social Security benefits, payments from states, and interest. The different parts of Medicare are funded in varying ways, and revenue sources dedicated to one part of the program cannot be used to pay for another part.

- Part A, which covers inpatient hospital stays, skilled nursing facility (SNF) stays, some home health visits, and hospice care, is financed primarily through a 2.9% tax on earnings paid by employers and employees (1.45% each). Higher-income taxpayers (more than $200,000 per individual and $250,000 per couple) pay a higher payroll tax on earnings (2.35%). Payroll taxes accounted for 90% of Part A revenue in 2021.

- Part B, which covers physician visits, outpatient services, preventive services, and some home health visits, is financed primarily through a combination of general revenues (73% in 2021) and beneficiary premiums (25%) (and 2% from interest and other sources). Beneficiaries with annual incomes over $85,000 per individual or $170,000 per couple pay a higher, income-related Part B premium reflecting a larger share of total Part B spending, ranging from 35% to 85%.

- Part D, which covers outpatient prescription drugs, is financed primarily by general revenues (74%) and beneficiary premiums (15%), with an additional 11% of revenues coming from state payments for beneficiaries enrolled in both Medicare and Medicaid. Higher-income enrollees pay a larger share of the cost of Part D coverage, as they do for Part B.

The Medicare Advantage program (Part C) is not separately financed. Medicare Advantage plans, such as HMOs and PPOs, cover Part A, Part B, and (typically) Part D benefits. Funds for Part A benefits provided by Medicare Advantage plans are drawn from the Medicare HI trust fund (accounting for 42% of Medicare Advantage spending on Part A and B benefits in 2021). Funds for Parts B and D benefits are drawn from the Supplementary Medical Insurance (SMI) trust fund. Beneficiaries enrolled in Medicare Advantage plans pay the Part B premium and may pay an additional premium for their plan.

What does Medicare trust fund solvency mean and why does it matter?

The solvency of the Medicare Hospital Insurance trust fund, out of which Part A benefits are paid, is a common way of measuring Medicare’s financial status, though because it only focuses on the status of Part A, it does not present a complete picture of total program spending. Medicare solvency is measured by the level of assets in the Part A trust fund. In years when annual income to the trust fund exceeds benefits spending, the asset level increases, and when annual spending exceeds income, the asset level decreases. This matters because when spending exceeds income and the assets are fully depleted, Medicare will not have sufficient funds to pay hospitals and other providers for all Part A benefits that are provided in a given year.

In the coming decade, based on current projections from the Medicare trustees, Part A spending will exceed Part A revenues each year beginning in 2023, leading to a gradual depletion of assets in the HI trust fund (Figure 2). For example, in 2023, the Medicare trustees project that the HI trust fund will begin the year with $172.4 billion in assets, but because spending is projected to exceed revenue by $3 billion, the trust fund is expected to end the year with $169.4 billion in assets. By the beginning of 2027, assets in the trust fund will have decreased to $93.3 billion, and with $45 billion more in spending than in revenues that year, assets will drop to $48.3 billion by the end of 2027. And in 2028, the $48.3 billion in assets in the HI trust fund at the start of the year are projected to be insufficient to cover the $56.9 billion shortfall between projected spending and revenues, leading to a deficit in the trust fund of $8.6 billion by the end of that year.

When is the HI trust fund projected to be depleted, and what happens if there is a shortfall?

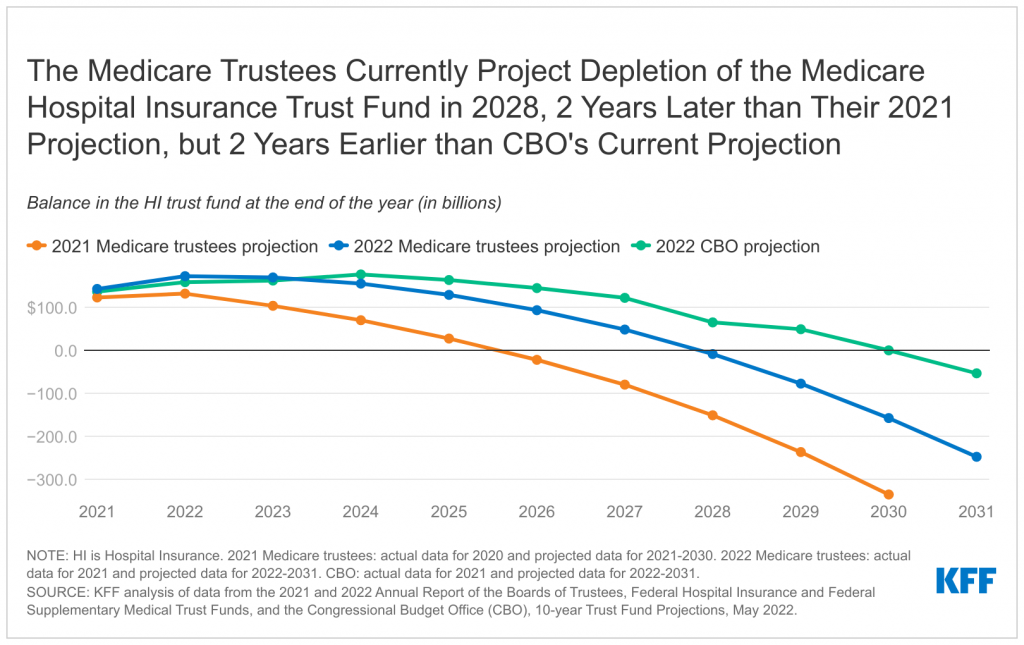

Each year, the Medicare trustees provide an estimate of the year when the HI trust fund asset level is projected to be fully depleted. In the 2022 Medicare Trustees report, the trustees projected that assets in the Part A trust fund will be depleted in 2028, six years from now. This is a modest improvement from the projection in the 2021 Medicare Trustees report, when the depletion date was projected to be 2026. A recent projection from the Congressional Budget Office estimated depletion of the HI trust fund somewhat further out, in 2030—but still within the next 10 years (Figure 3).

Since 1990, the HI trust fund has come within six years of depletion six times, including this year’s projection—in 1993, 1996, 1997, 2020, 2021, and 2022 (Figure 4). To improve the fiscal outlook of the trust fund in the mid-1990s, Congress enacted legislation to reduce Medicare spending obligations. To date, lawmakers have never allowed the HI trust fund to be fully depleted.

While some describe the trust fund as heading toward “bankruptcy” or “going broke”, it is important to note that the Medicare program will not cease to operate if assets are fully depleted, because revenue will continue flowing into the fund from payroll taxes and other sources. Based on data from the Medicare trustees, in 2028, Medicare will be able to cover almost all of Part A benefits spending with revenues plus the small amount of assets remaining at the beginning of the year, and just under 90% with revenues alone in 2029 through 2031, once the assets are depleted. However, there is no automatic process in place or precedent to determine how to apportion the available funds or how to fill the shortfall.

How large is the projected shortfall?

To address the shortfall between Part A spending and revenues over the next decade, based on the Medicare trustees’ projections, a total of $247.4 billion in spending reductions or additional revenues, or some combination of both, would be needed to cover the total deficit between 2028 (the year of trust fund depletion) and 2031 (the final year in the trustees’ projection period) (Figure 5). This $247.4 billion deficit represents the cumulative difference between Part A spending and revenues over these years, after taking into account the assets in the trust fund between 2021 and 2028 that can be used to pay for Part A spending until the assets are depleted. Over a longer 75-year timeframe, the Medicare Trustees estimate that it would take either an increase of 0.70% of taxable payroll or a 15% reduction in benefits to bring the HI trust fund into balance.

Are Medicare Part B and Part D also facing insolvency?

The Hospital Insurance trust fund provides financing for only one part of Medicare, and therefore represents only one part of Medicare’s financial picture. While Part A is funded primarily by payroll taxes, benefits for Part B physician and other outpatient services and Part D prescription drugs are funded by general revenues and premiums paid for out of separate accounts in the Supplementary Medical Insurance, or SMI, trust fund. The revenues for Medicare Parts B and D are determined annually to meet expected spending obligations, meaning that the SMI trust fund does not face a funding shortfall, in contrast to the HI trust fund. But higher projected spending for benefits covered under Part B and Part D will increase the amount of general revenue funding and beneficiary premiums required to cover costs for these parts of the program in the future.

What factors affect the solvency of the HI trust fund?

The solvency of the HI trust fund is affected by several factors. In addition to legislative and regulatory changes that affect Part A spending (both utilization of services and payments for services provided by hospitals, skilled nursing facilities, and other providers, and for Part A services covered by Medicare Advantage plans) and revenues, Part A trust fund solvency is affected by:

- the level of growth in the economy, which affects Medicare’s revenue from payroll tax contributions: economic growth which leads to higher employment and wages boosts revenue to the trust fund, while an economic downturn can have the opposite effect,

- overall health care spending trends: higher health care price and cost growth can lead to higher spending for services covered under Medicare Part A which could hasten the depletion date, while moderation in the growth of prices and costs could slow spending growth, and

- demographic trends: this includes the aging of the population, which is leading to increased Medicare enrollment (especially between 2010 and 2030 when the baby boom generation reaches Medicare eligibility age); a declining ratio of workers per beneficiary making payroll tax contributions, which means lower revenue; and other factors, such as fertility rates and immigration.

To illustrate how such factors can influence solvency projections, recent trust fund projections from the Congressional Budget Office demonstrate the sensitivity of the depletion date to changing economic conditions related to the COVID-19 pandemic. During a period of just under 30 months, between January 2020 and May 2022, the HI trust fund depletion date projected by CBO shifted from 2025 (projected in January 2020, prior to the COVID-19 pandemic) to 2024 (projected in September 2020, during the pandemic and in the midst of a significant downturn in the economy), to the most recent estimate of 2030 (projected in May 2022) based primarily on projections of higher revenues from payroll taxes resulting from higher employment and wage growth.

What is the longer-term outlook for Medicare financing and trust fund solvency?

Over the longer term, the Medicare program overall faces financial pressures associated with higher health care costs and an aging population. It remains to be seen how the recent volatility in the economy, higher inflation, and the longer-term health effects of the COVID-19 pandemic will affect spending and revenue projections for the HI trust fund. To sustain Medicare for the long run, policymakers may consider adopting broader changes to the program that could include both reductions in payments to providers and plans or reductions in benefits, and additional revenues, such as payroll tax increases or new sources of tax revenue. Evaluating such changes would likely involve careful deliberation about the effects on federal expenditures, the Medicare program’s finances, and beneficiaries, health care providers, and taxpayers.

This work was supported in part by Arnold Ventures. KFF maintains full editorial control over all of its policy analysis, polling, and journalism activities.