As ACA Marketplace Enrollment Reaches Record High, Fewer Are Buying Individual Market Coverage Elsewhere

With Marketplace enrollment at a record high, the upcoming open enrollment period could be among the busiest yet. In addition to Marketplace enrollees renewing coverage, uninsured people and those buying individual coverage off-Marketplace may want to check if they are eligible for expanded subsidies under the recently passed Inflation Reduction Act. As we approach the tenth annual ACA open enrollment, let’s take a step back to see how many people are currently signed up for individual market coverage on- and off-Marketplace and what they might consider when shopping for health coverage.

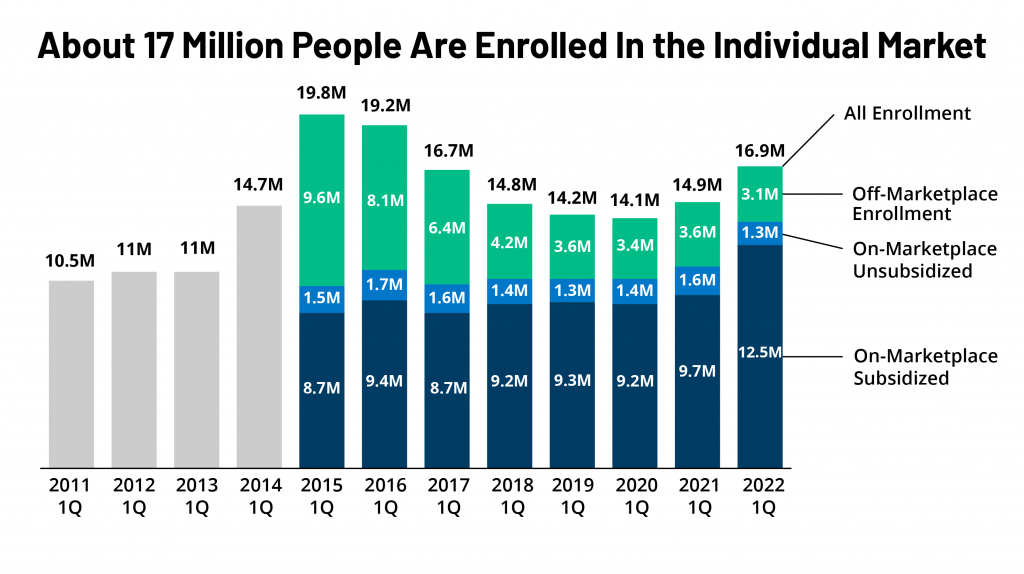

Here, we combine federal enrollment data with administrative data insurers report to state regulators, as compiled by Mark Farrah Associates, to see how many people are signed up for each type of individual market coverage, both on- and off-Marketplace and with or without subsidies, as of early 2022. We find that as Marketplace enrollment has reached record highs, fewer people are buying coverage off-Marketplace, but the overall individual market is nonetheless growing.

Individual market enrollment is growing again, driven by enhanced subsidies. As of early 2022, we estimate there are 16.9 million people with individual market coverage, the highest enrollment since 2016 (Figure 1). The individual health insurance market grew rapidly in the early years of ACA implementation, reaching nearly 20 million people in early 2015, nearly double the approximately 11 million signed up before the ACA. However, these enrollment gains were partially offset by subsequent declines, particularly among people not receiving subsidies amid steep premium increases the following years. By early 2020, the individual market had declined to about 14 million enrollees. (Because some plans do not file quarterly data, we adjust these plans’ enrollment numbers based on enrollment changes seen in plans that do file quarterly. We also remove likely Children’s Health Insurance Program, or CHIP, enrollees from the individual market total.)

With passage of enhanced subsidies in the American Rescue Plan Act (ARPA), combined with boosted outreach and an extended enrollment period, 2021 marked the first year since 2015 when there was an increase in individual market enrollment. Individual market enrollment grew about 5% from 14.1 million in first quarter 2020 to 14.9 million in first quarter 2021.

The ARPA’s subsidies didn’t simply bring people from off-Marketplace plans to the Marketplace; the subsidies also helped bring overall individual market enrollment higher, up to 16.9 million in early 2022, an increase of about 20% from early 2020.

Now, with enhanced subsidies in place, the vast majority of people buying coverage on the individual market are subsidized. The recently passed Inflation Reduction Act continues the ARPA subsidies without interruption for another three years through 2025. That means premiums are capped for people with incomes over 400% of the poverty level ($111,000 for a family of 4) who were ineligible for subsidies previously, and those who were already eligible for subsidies are paying even less than they were before. Overall, about three in four individual market enrollees are now subsidized – by far the highest share since the ACA was implemented – and some of those who aren’t receiving a subsidy might find they are eligible if they moved onto the Marketplace.

Heading into 2023 open enrollment, we estimate there are still about 3 million people buying unsubsidized coverage off-Marketplace, including some in non-ACA-compliant plans (like grandfathered and short-term plans). Despite Trump Administration efforts to promote non-compliant coverage, the number of people in non-compliant plans has fallen each year. Using federal risk adjustment and effectuated enrollment data, we estimate 1.3 million people were in non-compliant plans in mid-2021, compared to 5.7 million in mid-2015. Although we don’t yet have complete 2022 data, it’s likely ACA-compliant enrollment (both on- and off-Marketplace) is currently at a record high and that non-compliant enrollment is at a record low.

Some off-Marketplace enrollees will find they are still ineligible for subsidies, even with enhanced subsidies. Undocumented immigrants and people with affordable offers of employer coverage are ineligible for Marketplace subsidies. Additionally, although there is no longer an upper income limit for subsidies, people with higher incomes who would pay less than 8.5% of their income for an unsubsidized benchmark silver plan are ineligible for subsidies because their premium isn’t high enough to trigger financial help. Even so, some of the latter group may find it advantageous to purchase on the Marketplace because if they experience midyear changes in their income or other circumstances, they may begin receiving subsidies mid-year without changing plans or they could retroactively claim a subsidy when they file taxes.

How might future premium increases affect people in the individual market? Looking back over the last nine years of the ACA, changes in individual market enrollment closely mirror changes in what people had to pay for coverage. In years when premiums were rising steeply from 2016-2018, unsubsidized individual market enrollment fell. When premiums held mostly steady in 2019 and 2020, so did individual market enrollment. Then, as new subsidies became available in 2021 and 2022, individual market enrollment picked up again, driven by an increase in the number of subsidized enrollees.

Heading into 2023, we may see unsubsidized premiums rise more steeply than in past years, pushed up by rising health care prices and utilization. If premiums do rise, we may see further erosion of unsubsidized off-Marketplace coverage. However, unlike when premiums rose in past years, the Inflation Reduction Act’s enhanced subsidies could shield the vast majority of individual market enrollees from increases, even those with higher incomes. In fact, some people who aren’t subsidized in 2022 may find premium increases in 2023 make them newly eligible for subsidies (if their benchmark premium rises above 8.5% of their income). But, to take advantage of subsidies, they would need to shop on the Marketplace during open enrollment.