We Should Channel People Into Medicare Advantage Plans Where They Won’t Have Amputations or Go Blind (Part 2)

By GEORGE HALVORSON

Former Kaiser Permanente CEO George Halvorson has written on THCB on and off over the years, most notably with his proposal for Medicare Advantage for All post-COVID. He wrote a piece in Health Affairs last year arguing with the stance of Medicare Advantage of Don Berwick and Rick Gilfillan (Here’s their piece pt1, pt2). We also published his criticism (Part 1. Part 2. Part 3) of Medpac’s analysis of Medicare Advantage. Now Medpac is meeting again and George is wondering why they don’t seem to care about diabetic foot amputations. We published part one last week. This is part two– Matthew Holt

We have more amputations and we have more people going blind in our fee for service Medicare program today because we buy care so badly and because we have no quality programs or care linkages for our chronically Ill patients and our low income people in that program.

We have far better care in our Medicare Advantage programs at multiple levels today, and we should be building on that better care for everyone.

The important and invisible truth is that we have major successes in providing better care to Medicare Advantage members across the entire spectrum of that package of care. The sad truth is that MedPac actually keeps those huge differences in care performance by the plans secret from the Congress and from the American public for no discernable or legitimate reason.

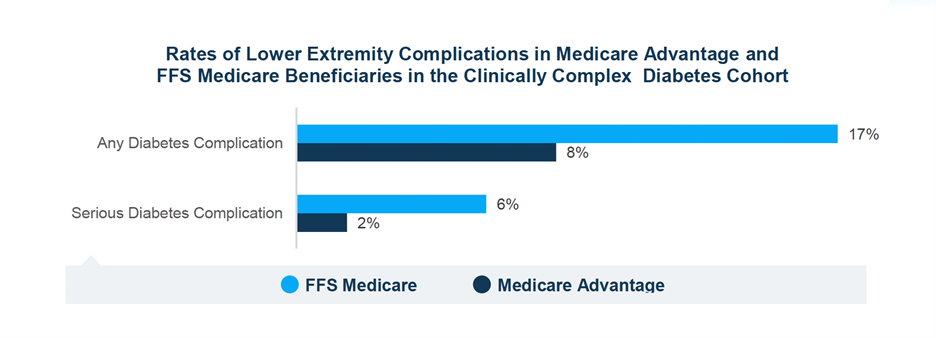

We have an epidemic of amputations that are causing almost a fifth of our fee for service diabetes patients who get foot ulcers to lose limbs. The number of patients in both standard Medicare Advantage and in the Medicare Advantage Special Needs Programs who undergo amputations and who have that functional and dysfunctional care failure is a tiny fraction of that number.

MedPac pretends the program does not exist. They did a lengthy study on the overall special needs dual eligible program for Medicare a year ago without mentioning the plans or describing any of the things that the plans to do make care better for those patients.

We know that in fee for service Medicare, 20% percent of diabetes patients routinely get ulcers and 20% of those ulcers to turn into amputations. There are far fewer amputations for Medicare Advantage plan members—and we have failed our overall Medicare population badly by not sharing that information more broadly at open enrollment time.

Medicare Advantage Five Star quality plans that have created a culture of quality improvement at many care sites. Those plans compete fiercely on quality goals and take pride in attaining and celebrating the highest scores. We started with less than 10% of plans with the highest scores for the first enrollment periods. Now more than 90% of Medicare Advantage members are able to choose between four and five star plans.

The quality measurements that are missing from the set of consumer choices are the ones that relate to the most serious issues for the consumers—and that’s where MedPac should be putting the right set of information on the table to compare the two systems of care. Large amounts of data show that amputations caused by diabetes follow very predictable patterns.

Roughly 33% of Medicare patients will have diabetes. 20% of diabetics will have ulcers. That number goes up to 30% for some patient groups—but you can count of at least 20% overall to have ulcers. We know that the overarching pattern in fee for service Medicare is for 20% of those ulcers to end up needing and getting amputations.

We spend $8 billion on mputations and the average cost of an amputation is now slightly over $100,000. The Medicare Advantage Plans are all capitated—with a fixed payment paid per month for each member—so we know that the plans will not gain revenue by doing any additional amputations and can reduce expenses by avoiding amputations. So the Medicare Advantage plans who are managing their care look to do exactly that. They try to have fewer than 20% of their patients with ulcers. They teach dry socks to every patient, and that can actually reduce the number of ulcers by upwards of 30%. They look at feet of diabetic patients to do early detection, and when they detect an ulcer, they do various medical and functional things to cure it. They know that an ulcer will cost them $100,000 if it becomes an amputation, so they do the kinds of patient care approaches that both reduce and cure ulcers. So amputation prevention efforts tend to be successful.

Even the less successful programs end up with half as many ulcers and less than a third of the amputations compared to fee for service. Some best care settings get the amputation rate down to two percent.

Managing care for capitated health plans is important work—and MedPac should be keeping track of and reporting both numbers as a good measure for telling people what kind of care setting they are in. Sharing that information with prospective members at open enrollment might be useful in helping people decide whether to join a plan.

There are a much lower number of those amputations in the Medicare

Advantage plans, but that information is not shared either with the enrollees each or with the patient communities as people are making their decisions about where to receive care for the following year. If MedPac had made any efforts to share that information with both Medicare Enrollees and Congress or with the news media and the general public, that information sharing process might have created decisions by our Medicare members that might have kept us from having the highest rate of amputations in the western world.

It’s Wrong To Have So Many People Going Blind

Maybe the saddest and hardest to accept care failure in our country today is having far too many fee for service Medicare people going blind. That is sad and painful for us as a country because we should be able to prevent blindness for most of those patients and we just aren’t doing it.

It is a not a good thing to go blind.

We have far too many people losing their vision in this county and it happens overwhelmingly with our lowest income people who aren’t getting the right care.

Vision loss clearly does not need to happen. Blood sugar is the key for those patients and we know how to use that key. People on fee for service Medicare who have personal higher levels of net worth—and who often buy their own Medicare supplemental insurance plans—tend to have personal doctors to help manage their blood sugar, but the vast majority of low income patients don’t have that care and too many of their lives are badly damaged today by going blind.

It ought to be a crime for us as nation for us to know what can be done to keep that wave of blindness from happening for all those people and then not to be somehow insisting on getting more people into care settings where that blindness does not happen. We can actually prevent more than 60% of vision loss with basic blood sugar management. But it is not happening in fee for service Medicare. All of the Medicare Advantage plans are capitated in their payment model, so they routinely identify every diabetic and then those plans all tend to do the right things to help blood sugar management for those patients. Far too many low income people who are not on Medicare Advantage plans go blind and then they stay blind for life.

Our government and community leaders who have some influence over their voters and their constituents who don’t want low income people in their communities to lose their vision could simply say to their that they will have a much lower risk of going blind if they join Medicare Advantage plans.

We Do Need High Risk People To Be Enrolled Soon In Special Needs Plans.

The people who are most vulnerable are those who have dual eligibility for both Medicare and Medicare. The dual eligibles with the lowest income levels and the highest levels of health risk and difficulties are the people who are highly in need of serious care who have not had good or coordinated care for most of their lives.

We owe a deep apology and we have a debt to many of those low income people for the inadequate and deficient care we have delivered to too many of them over years. Too many people have been damaged at multiple levels for multiple years by various social inequities and by basic disparities in health. Far too many people who have had inadequate and inequitable poor health need remedial and targeted help today in way that is only happening with Medicare Advantage plans.

What most people in our country—including our health economists, our health related news media, and our health care policy experts and pundits—do not know is that Medicare Advantage has a highly targeted and very competent Special Needs Program aimed directly at those people. Almost no one in the country knows or understands that the Special Needs Programs exist or do what they do– except for the four million people who have enrolled in the program with 90% satisfaction levels even during the Covid epidemic. Who does know?: the dedicated internal Team at CMS who have been running the Dual Eligible program well and who have been making it better every year with no fanfare or publicity.

The people who are enrolled in the dual eligible program clearly and obviously have massively better care. When they get enrolled in the Medicare Advantage dual eligible SPN program, they are half as likely to go blind and they are less that half as likely to have an amputation as the dual eligible who have no program or care processes or care enhancements at all.

Again—the plans provide care for a discount in their capitation levels in each county from the normal costs of their care—and provide much better care for less money than fee for service Medicare just because they are doing the right thing. For those people, the right thing works when you do it well.

We Need Capitation To Create The Cashflow To Achieve A Golden Age for Care

Capitation is a very different payment process and cash flow and it is needed to give the system the tools to make changes and to continuously improve. The Medicare Advantage capitation cash flow actually is badly needed right now, because it creates an entirely new opportunity to provide care. We should be on the cusp of an entirely new golden age for care if we do this right.

Medical science is exploding and expanding in multiple directions. We have going from a time when over half of the most serious diagnosis have some elements of misdiagnosis in them to an era of high levels of diagnostic accuracy accompanied by extensive care connectivity tools, artificial intelligence support for care algorithms that identify treatments, and medical science and that can now give us all a good solid tool kit for continuously improving care.

We are at the point today where blood samples can now predict with some level of accuracy upwards of forty cancers more than a year in advance of the cancer being visible. Electronic linkages to devices on our body in our home can predict with more than 80% accuracy whether a person is going to have a heart event of some kind within the next year.

We should be able to both anticipate the heart event and do the necessary things to avert many of them and we should be able to steer away from fatal results from a growing array of cancers.

We know in the Medicare Advantage tool kit that early responses to foot ulcer treatment and process enhancements prevent most of the highly expensive amputations. We should now know from cancer warnings how to treat most cancers at stage ones rather than at the extremely expensive stage four.

The Medicare Advantage business model is designed to improve care using the best tools. Medicare Advantage plans will take advantage of every one of those tools because they will be financially rewarded. They will have market impact because members will want to join the plans who can make those tools available for their future care. The very best high tech care sites should have safe futures because Medicare Advantage Plans will want to offer their services to enhance care.

Medicare fee for service has always denied access to the newest technology and there is no reason to believe that they will change that pattern now. It still doesn’t support electronic visits from patients. Having tests run in homes to do early diagnosis for all of those conditions isn’t likely to happen if fee for service Medicare is the way we pay for that care.

That means that the average cost of care in the counties for fee for service Medicare will have $100,000 stage four cancers just like they have most of the $100,000 amputations now. We should be able to change that trajectory if we put the right tools in place to do it.

We need to make sure to get the next generation of care tools in the hands of the Medicare Advantage plans. But we don’t need to offer that advice. If we allow the market model to work with the capitation payment business model, then the desire of the plans to make their customers happy will cause that set of enhancement programs to happen on its own.

We should be on the cusp of a golden age for care—and the Medicare Advantage Plans should be doing down paths into that technology to make that happen if we don’t screw it up.

Some People Still Believe That Upcoding Exists

The one strong concern that some people still express about the Medicare Advantage business model is that the business model of Medicare Advantage plans is somehow anchored on a funding trick or process called Upcoding. Even people who see all of the other benefit of the plans have been told in a wide range of seemingly credible settings that the Plans have somehow managed to manipulate the entire process based on upcoding the risk levels of the members to create an unfair and inappropriate cash flow.

MedPac has said in at least one setting that they believe that the plans have somehow fudged the coding process on the health status of the members and that all of the highly visible good financial results of the plans needs to be offset by 9% to give us an accurate perspective on the actual underlying numbers achieved by the plans.

That is a widely believed and widely repeated and never actually validated ghost number and having it echoed by a number of Medicare Advantage critics even today definitely keeps the support for Medicare Advantage from being less than it should. That number is and has been completely wrong. The upcoding issue has always been a highly politized and under-supported accusation. It has kept people from understanding that Medicare Advantage has been less costly with higher quality and higher benefits than the alternatives preferred by that set of critics believe to be true.

So what is true? Upcoding is now impossible. Literally impossible.

CMS completely killed and officially retired the actual coding system three years ago. They reinforced the death of the system clearly for the 2023 financial rule set and payment model. The plans now have nothing to code and that means that there is nothing to upcode.

CMS now gets their diagnosis information from the actual encounters that are filed at each point of care—along with the actual care delivered in each encounter. It’s a perfect and real time system for gathering the needed information about each encounter with complete accuracy and full context because the encounter gives both the care and the context for the care.

CMS has used that data. They now know the actual risk levels of the plans compared to the risk levels that come from their average county cost of care. That calculation tells the CMS numbers team that the risk levels for the plans are actually higher than the calculated risk levels that came from the old coding system which had some upcoding risk built in.

We now know from that data that the actual risk levels for the plans is higher than the old estimates of what critics of Medicare Advantage thought were upcoded numbers

MedPac has estimated for years that upcoding had skewed the numbers by 9%. Instead, CMS’ more complete and accurate data showed that the plan average capitation should go up by 8.5%

The plans will now need to figure out what to do with that higher number for next year because the plan surpluses already exceed what can be used from that 8.5% number. In any case, upcoding isn’t happening now and there’s no coding process for it to ever happen again.

We should be looking at the excellent work being done by CMS to enhance the quality enhancement program. The Five Star plan continues to perform at a very high level, In the first years of the program only 10% of members could choose a Four or Five Star plan. Today that’s more than 90%.

We have a new culture of care improvement in the country today that anchors on achieving those five stars. CMS is doing extremely good work to continuously improving that process to make the stars better.

Care Is Better For The Ones Who Need It Most

We are on the right track in multiple ways. The most important number on this chart is that the number of high risk dual eligibles from 19% down to the current total of 2% by providing extremely good care in systematic ways. We now need everyone in the country at high risk to go down that path.

Blind is bad. It’s just wrong that the number of people going blind is climbing to record numbers.

Let’s ask MedPac to redo their misleading Dual Eligibles report to show the actual care being delivered to all those low income people.

Let’s Bring Down The Cost Of Care By Continuously Improving Care

Let’s also look at what we need to do to bring down health care costs as a country. We are spending $4 trillion on care. Each of those $100,000 amputations is in that number. When we capitate the Medicare Advantage plans and when the plans manage to continuously improve care by not having to do those amputations, that $100,000 spend literally disappears from that $4 trillion number

Nothing else has that impact on the total cost of care.

We need to understand what that means to us as a county, because it is possible for us to reengineer care and to reduce the $4 trillion if we do it right.

Let’s convert to being a buyer and not just a payer for care, because Medicare Advantage shows us a way to do that. We can create a goal and then steer gently but firmly to that approach. Let’s take advantage of the fact that the current approach of better benefits and lower costs already has the Medicare Advantage plans costing members nearly $2,000 in annual savings per member.

In the meantime—let’s celebrate and protect our successes and let’s have a golden age for care. Let’s get all of the people who need special needs plans but aren’t in them to join those plans. That will keep them from being damaged at the rate they are currently being damaged.

The journal Diabetes Care just told us we can reduce the risk of diabetic retinopathy by 76 percent by doing the right thing for those patients.

It would be criminal to do anything less.

George Halvorson is Chair of the Institute for InterGroup Understanding and was CEO of Kaiser Permanente from 2002-14