CVS Health Among Potential Buyers For Signify Health

Yet another massive retailer is inching closer to buying a company that is focused on the home as a setting of care.

CVS Health Corp. (NYSE: CVS) plans to make a bid on Signify Health (NYSE: SGFY), according to a new report from The Wall Street Journal.

Both companies have been in the news spotlight of late. CVS Health has been overt about its efforts to reach further into the home; it has been targeting traditional home health agencies, and it was reportedly interested in primary care provider One Medical (Nasdaq: ONEM).

Amazon (Nasdaq: AMZN) agreed to acquire One Medical for $3.9 billion in late July.

Signify is supposedly looking at “strategic alternatives” for the business, including a potential sale. CVS has emerged as the first potential suitor, though others “are in the mix,” according to WSJ, citing sources “familiar with the matter.”

Those others could include managed care companies and private equity firms, which also have been interested in purchasing home-based providers. The New York-based private equity firm New Mountain Capital is already a Signify investor, and it has been so for close to five years.

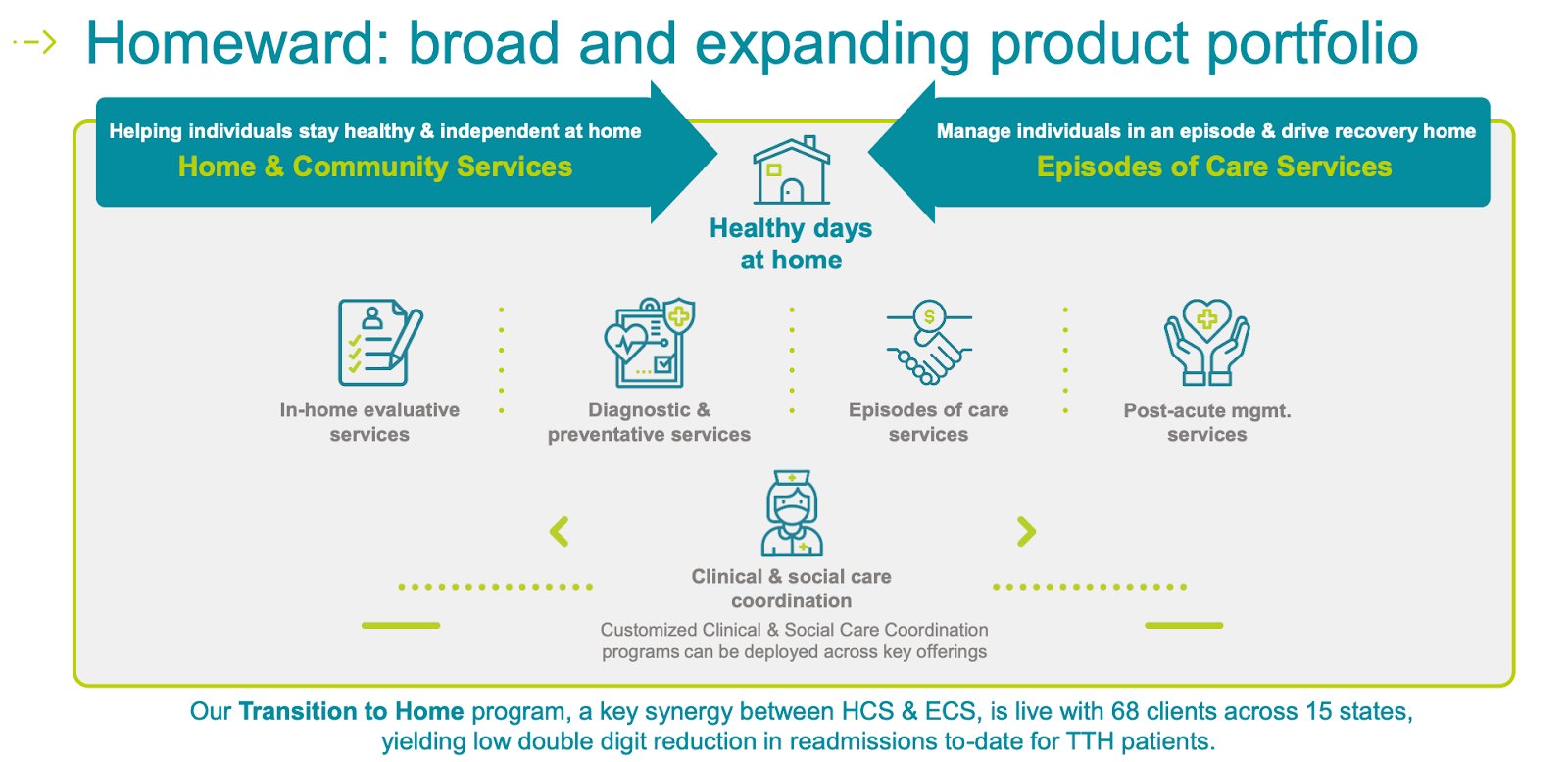

“Regarding recent media reports focused on potential M&A, we do not comment on market speculation, and we will not answer questions on the topic,” Signify CEO Kyle Armbrester said Thursday on the company’s second-quarter earnings call.

Signify declined to comment on this story.

Dallas-based Signify went public in early 2021. Its market cap currently is around $4.7 billion, with its stock price rising over the last week after rumors of a potential sale cropped up.

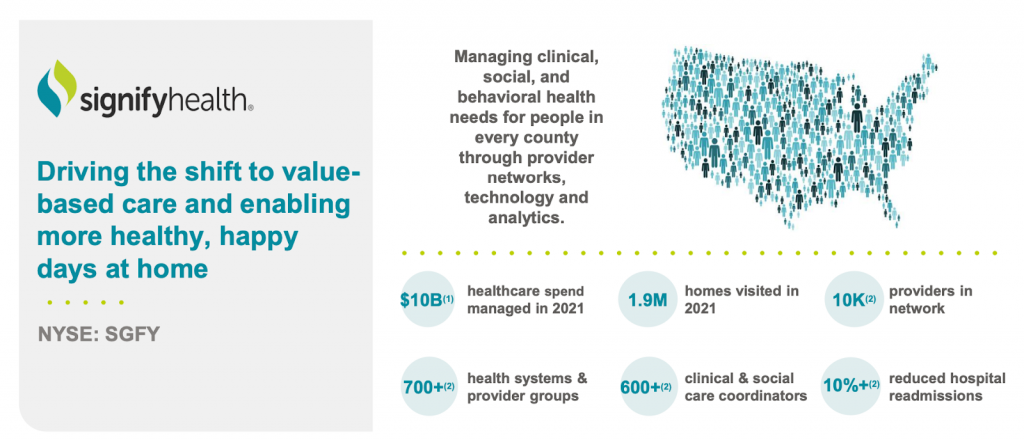

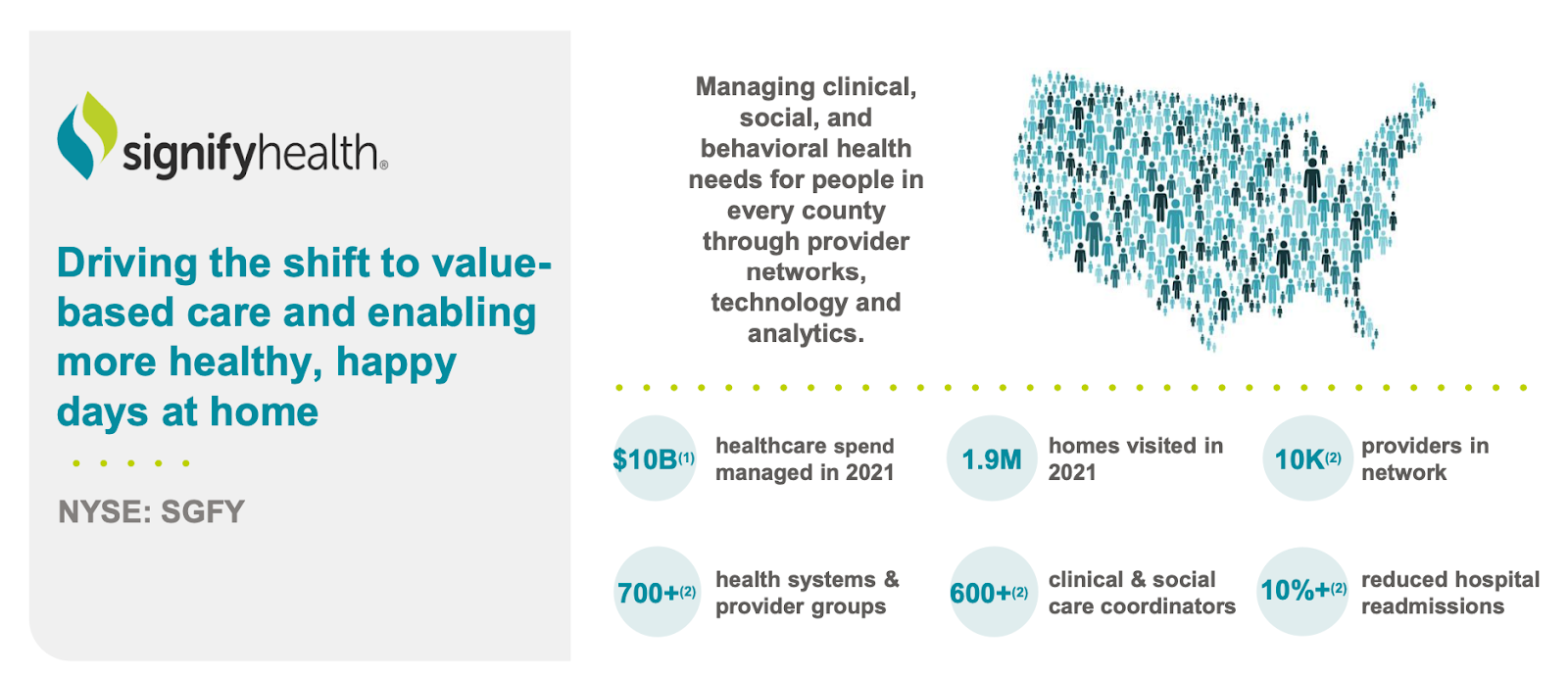

The company partners with health plans, health systems, physician groups, employers and other health care providers to help enable at-home care through its proprietary technology and analytics. It additionally provides at-home evaluations, usually on behalf of Medicare Advantage plans. It conducted 624,000 of those in the second quarter alone.

As of recently, Signify’s business has materially changed. It announced in July that it would be leaving the Centers for Medicare & Medicaid Services’ (CMS) Bundled Payments for Care Improvement-Advanced (BPCI-A) program due to adjustments from CMS on trend calculations.

In the aftermath, the company has expressed its desire to lean further into its home and community services (HCS) segment.

“This decision will allow us to invest more in supporting the growth of our in-home services, our total cost of care enablement platform, and the needs of our health plan and provider clients,” Armbrester said.

In addition to Signify’s core business, CVS Health may also be interested in Caravan Health, which was Signify’s first acquisition in February for $250 million. Caravan is an accountable care organization manager, but it also honed in on population health management and value-based payment programs.

While much of the mainstream coverage of CVS Health’s aggressive growth goals has been focused on the primary care side, the company has been keyed in on the home for the last year. It already has plenty of home-based care capabilities of its own – through Aetna and otherwise – including at-home infusion and kidney care, among others.

“We are expecting to enhance our health services in three categories: primary care, provider enablement and home health,” CVS Health CEO Karen Lynch said during the company’s second-quarter earnings call Wednesday.

Regarding the topic of acquiring specifically to get into home health care, CVS Health CFO Shawn Guertin said in February that home-based care entities were “high on the list” when it came to near-term M&A.

“It’s hard to predict the exact order with which things will potentially show up, if this is something you decide that you’d rather acquire than build,” Guertin said. “But yes, absolutely, [we’re interested in] things that make sense to sort of extend the care continuum – particularly to a Medicare population. [That] would make a lot of sense and they’d be high on the list.”

A deal for Signify Health is not a shoo-in for a few reasons. Similar to the One Medical deal with Amazon, CVS Health could simply be outbid. It’s also not a certainty just yet that Signify Health will be acquired at all. Last week’s initial report from WSJ called it “far from guaranteed.”

As of Monday afternoon, Signify’s stock price was at $22 per share, $2 less than its IPO price, but about $5 up over a five-day trading period. Goldman Sachs and Deutsche Bank are advising the company during its exploration of strategic alternatives.

Despite the current stock price, it’s possible that Signify could garner far more per share in a potential sale. In fact, the price per share could be upwards of $39, according to a Seeking Alpha report.

The retailer’s strategy

Signify’s business strategy switch was followed almost immediately by rumors of a sale, which raised eyebrows.

But it could have much more to do with the market for its services – and not what’s happening internally at the company. After all, if CVS Health, PE firms and managed care companies are willing to compete for the company, a sale makes sense for its shareholders.

CVS Health, Amazon, Walmart (NYSE: WMT) and Walgreens Boots Alliance (Nasdaq: WBA) have all been moving further into health care, and into the home, over the past few years.

Walgreens, however, is CVS Health’s most similar peer based on the services and products it offers. While CVS Health has the massive insurer Aetna, Walgreens has a head start on CVS Health in the home, having already invested over $6 billion in the home-focused primary care provider VillageMD and $330 million in the health-at-home solutions company CareCentrix.

While CVS Health failed to acquire One Medical, it’s likely that it will acquire a similar company in the near future, according to Lynch. Meanwhile, an acquisition of Signify Health – a similar company to CareCentrix – would already make its portfolio much more competitive with Walgreens.

As for what this could mean for traditional home health providers, much of that is still up in the air.

CVS and Aetna moving further into the home could be good for potential partnerships, but at the same time, providers have recently criticized platforms like CareCentrix and Signify as “middlemen” who take money from providers when being paid out – mostly by MA plans – for home health services.