Americans’ Challenges with Health Care Costs

For many years, KFF polling has found that the high cost of health care is a burden on U.S. families, and that health care costs factor into decisions about insurance coverage and care seeking. These costs also rank as a top financial worry. This data note summarizes recent KFF polling on the public’s experiences with health care costs. Main takeaways include:

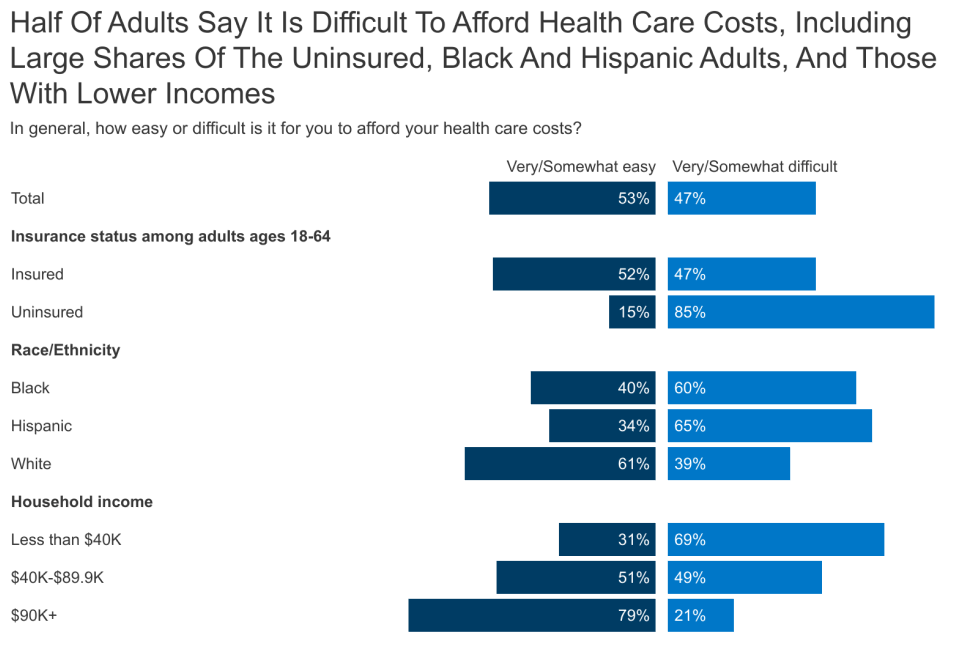

- About half of U.S. adults say they have difficulty affording health care costs. About four in ten U.S. adults say they have delayed or gone without medical care in the last year due to cost, with dental services being the most common type of care adults report putting off due to cost.

- Substantial shares of adults 65 or older report difficulty paying for various aspects of health care, especially services not generally covered by Medicare, such as hearing services, dental and prescription drug costs.

- The cost of health care often prevents people from getting needed care or filling prescriptions. About a quarter of adults say they or family member in their household have not filled a prescription, cut pills in half, or skipped doses of medicine in the last year because of the cost, with larger shares of those in households with lower incomes, Black and Hispanic adults, and women reporting this.

- High health care costs disproportionately affect uninsured adults, Black and Hispanic adults, and those with lower incomes. Larger shares of U.S. adults in each of these groups report difficulty affording various types of care and delaying or forgoing medical care due to the cost.

- Those who are covered by health insurance are not immune to the burden of health care costs. About one-third of insured adults worry about affording their monthly health insurance premium, and 44% worry about affording their deductible before health insurance kicks in.

- Health care debt is a burden for a large share of Americans. About four in ten adults (41%) report having debt due to medical or dental bills including debts owed to credit cards, collections agencies, family and friends, banks, and other lenders to pay for their health care costs, with disproportionate shares of Black and Hispanic adults, women, parents, those with low incomes, and uninsured adults saying they have health care debt.

- Affording gasoline and transportation costs is now a top worry for Americans followed by unexpected medical bills. While worry over gasoline and transportation costs has risen markedly since 2020, significant shares of adults still say they are worried about affording medical costs such as unexpected bills, deductibles, and long-term care services for themselves or a family member.

Difficulty Affording Medical Costs

Many U.S. adults have trouble affording health care costs. While lower income and uninsured adults are the most likely to report this, those with health insurance and those with higher incomes are not immune to the high cost of medical care. About half of U.S. adults say that it is very or somewhat difficult for them to afford their health care costs (47%). Among those under age 65, uninsured adults are much more likely to say affording health care costs is difficult (85%) compared to those with health insurance coverage (47%). Additionally, at least six in ten Black adults (60%) and Hispanic adults (65%) report difficulty affording health care costs compared to about four in ten White adults (39%). Adults in households with annual incomes under $40,000 are more than three times as likely as adults in households with incomes over $90,000 to say it is difficult to afford their health care costs (69% v. 21%). (Source: KFF Health Care Debt Survey: Feb.-Mar. 2022)

The cost of care can also lead some adults to skip or delay seeking services. One-third of adults say they or another family member living in their household has not gotten a medical test or treatment that was recommended by a doctor in the past year because of the cost, while about four in ten (43%) report that they or a family member in their household has put off or postponed needed health care due to cost. The cost of care, medical tests, and treatments can also have disproportionate impacts among different groups of people. For instance, half of women say they have put off or postponed getting health care they needed because of the cost, compared to about one-third of men (35%), four in ten women say they have not gotten a recommended medical test or treatment due to cost compared to about a quarter of men (26%). Adults ages 65 and older, who are eligible for health care coverage through Medicare, are much less likely than younger age groups to say they have not gotten a test or treatment because of cost.

Six in ten uninsured adults under the age of 65 say they have postponed getting health care they needed due to cost compared to about half of insured adults (48%). Similarly, uninsured adults are also more likely to report skipping recommended tests or treatment due to cost than adults with insurance. Health insurance, however, does not offer ironclad protection as more than a third of those with insurance (37%) still report not getting a recommended test or treatment due to cost. Among adults ages 18-64 with employer-sponsored or self-purchased health insurance, half of those with higher or highest deductible plans say they or a family member has put off getting the health care they needed due to the cost, compared to four in ten (41%) with lower or zero deductible plans. (Source: KFF Health Care Debt Survey: Feb.-Mar. 2022)

KFF Health polling from March 2022 also looked at the specific types of care adults are most likely to report putting off and found that dental services are the most common type of medical care that people report delaying or skipping, with 35% of adults saying they have put it off in the past year due to cost. This is followed by vision services (25%), visits to a doctor’s offices (24%), mental health care (18%), hospital services (14%), and hearing services, including hearing aids (10%). (Source: KFF Health Tracking Poll: March 2022)

A 2022 KFF report found that people who already have debt due to medical or dental care are disproportionately likely to put off or skip medical care. Half (51%) of adults currently experiencing debt due to medical or dental bills say in the past year, cost has been a probititor to getting the medical test or treatment that was recommended by a doctor. (Source: KFF Health Care Debt Survey: Feb.-Mar. 2022)

Prescription Drug Costs

For many U.S. adults, prescription drugs are another component of their routine care. Among those currently taking prescription drugs, one in four say they have difficulty affording their cost, including about one third who take four or more prescription drugs (33%) and those in households with annual incomes under $40,000 (32%), and four in ten Hispanic adults. (Source: KFF Health Tracking Poll: October 2021)

The high cost of prescription drugs also leads some people to cut back on their medications in various ways or to try to obtain medications outside of a clinical setting. About a quarter (23%) of adults say they or family member in their household have not filled a prescription, cut pills in half, or skipped doses of medicine in the last year because of the cost, with larger shares of those in households with lower incomes, Black and Hispanic adults, and women reporting this. Few adults (10% among total) across income and gender say that they or a member of their household has purchased medications outside the U.S. due to cost, though there are notable differences across race and ethnicity. About one in five (22%) Hispanic adults say they or a family member has done so. Eight percent of adults say they have traded, purchased, or accepted donations of leftover medications from another person. (Source: KFF Health Care Debt Survey: Feb.-Mar. 2022)

Health Care Debt

In June 2022, KFF released an analysis of the KFF Health Care Debt Survey, a companion report to the investigative journalism project on health care debt conducted by KHN and NPR, Diagnosis Debt. This project found that health care debt is a wide-reaching problem in the United States and that 41% of U.S. adults currently have some type of debt due to medical or dental bills from their own or someone else’s care, including about a quarter of adults (24%) who say they have medical or dental bills that are past due or that they are unable to pay, and one in five (21%) who have bills they are paying off over time directly to a provider. One in six (17%) report debt owed to a bank, collection agency, or other lender from loans taken out to pay for medical or dental bills, while similar shares say they have health care debt from bills they put on a credit card and are paying off over time (17%). One in ten report debt owed to a family member or friend from money they borrowed to pay off medical or dental bills.

While four in ten U.S. adults have some type of health care debt, disproportionate shares of lower income adults, the uninsured, Black and Hispanic adults, women, and parents report current debt due to medical or dental bills.

Vulnerabilities and Worries About Rising Costs

KFF polling in 2020 found that unexpected medical bills were at the top of the list of people’s financial worries, outpacing worry over affording other types of health care and basic expenses like housing, transportation, utilities, and food. More recently, inflation raised the cost of basic living expenses including, most notably, gasoline and other transportation costs. With that came increased worries about being able to afford these expenses. A March 2022 KFF Health Tracking Poll finds that affording gasoline or other transportation costs is now a top concern for adults in the U.S., with about seven in ten (71%) saying they are either “very worried” or “somewhat worried” about being able to afford these costs (up from 40% who said the same in February 2020). Second to gas and transportation costs, about six in ten adults report being worried about affording unexpected medical bills (58%), while half say they are worried about monthly utilities like electricity (50%). At least four in ten are worried about being able to afford food (47%), long-term care services for themselves or a family member (45%), their rent or mortgage (43%), or their prescription drug costs (43%). Those with health insurance continue to have worries about affording care, as about four in ten worry about affording their health insurance deductible (44%) and more than one-third (36%) are worried about being able to afford their monthly health insurance premium. Those with lower household incomes are more likely to be worried about each of these things, see the full report for more details, (Source: KFF Health Tracking Poll: March 2022)

Affording dental, hearing, and vision care is also an issue among adults 65 and older as those benefits are not generally covered by Medicare. See the October 2021 Health Tracking Poll for a deeper dive into health care costs and challenges among older adults.

Many U.S. adults may be one unexpected medical bill from falling into debt. About half of U.S. adults say they would not be able to pay an unexpected medical bill that came to $500 out of pocket. This includes one in five (19%) who would not be able to pay it at all, 5% who would borrow the money from a bank, payday lender, friends or family to cover the cost, and one in five (21%) who would incur credit card debt in order to pay the bill. Women, those with lower household incomes, Black and Hispanic adults are more likely than their counterparts to say they would be unable to afford this type of bill. (Source: KFF Health Care Debt Survey: Feb.-Mar. 2022)