Medicaid Financial Eligibility in Pathways Based on Old Age or Disability in 2022: Findings from a 50-State Survey

Medicaid is an important source of health and long-term care coverage for seniors and people with disabilities. The Medicaid pathways in which eligibility is based on old age or disability are known as “non-MAGI” pathways because they do not use the Modified Adjusted Gross Income (MAGI) financial methodology that applies to pathways for pregnant people, parents, and children with low incomes. In addition to considering old age/disability status and income, many non-MAGI pathways also have asset limits.

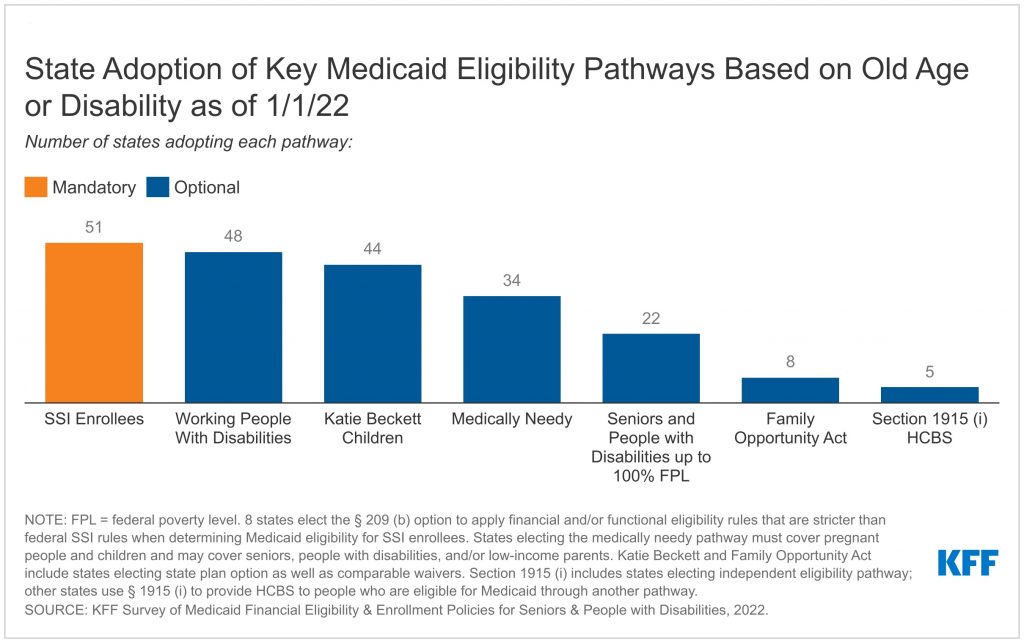

Nearly all non-MAGI pathways are optional, resulting in substantial state variation (Figure 1). Each group has different rules about income and assets, making eligibility complex. The Appendix provides details about the major non-MAGI pathways included in this survey, including pathways available to seniors and people with disabilities generally and pathways limited to people using long-term services and supports (LTSS) in nursing homes or other institutions or in the community. This issue brief presents state-level data on Medicaid financial eligibility criteria and adoption of the major non-MAGI pathways as of January 2022. The data were collected from March through May 2022 in KFF’s survey of Medicaid state eligibility officials. Overall, 50 states and the District of Columbia responded to the survey, though response rates to specific questions varied. Responses were supplemented with publicly available information where available. The Appendix tables contain detailed state-level data.

At least five states have adopted new financial eligibility expansions in non-MAGI pathways that take effect after January 2022. In January 2023, New York will join California as the second state to increase the income limit for seniors and people with disabilities to 138% FPL ($1,563 per month for an individual in 2022), the same limit as for MAGI populations. New York’s non-MAGI asset limits also will increase by about 50% in January 2023 (from $16,800 to $28,134 for an individual and from $24,600 to $37,908 for a couple). Between July 2022 and January 2024, California will phase in the elimination of asset limits in its pathway for seniors and people with disabilities up to 138% FPL and its working people with disabilities buy-in, placing access to coverage on the same financial terms as MAGI pathways which do not have an asset limit. Three other states are adopting changes that take effect July 1, 2022: Connecticut is increasing its income limit for seniors and people with disabilities up to about 94% FPL; Maryland is eliminating its income limit for the working people with disabilities buy-in; and Minnesota is increasing its income limit for medically needy seniors and people with disabilities to 100% FPL.

Though many states adopted policies to expand Medicaid eligibility for non-MAGI groups using emergency authorities during the PHE, very few states reported plans to continue these policies after the PHE ends. The only policy that some states plan to continue is reducing or eliminating premiums. Three states (CA, IL, NH) are planning to continue reducing or eliminating premiums (depending on state legislation in CA and NH), out of the 20 states that reported adopting this policy using emergency authorities.

Looking ahead, Medicaid remains an essential, and often the sole, source of medical and LTSS coverage for many seniors and nonelderly adults and children with disabilities. While the income limits associated with the non-MAGI pathways vary among states, they generally remain low. However, a notable minority of states are adopting non-MAGI financial eligibility expansions, including some that adopt the same financial eligibility limits that apply to MAGI populations (138% FPL and no asset test). States’ choices about which pathways to cover are an important baseline from which to monitor seniors and people with disabilities’ access to coverage, including LTSS.